Customers would require that every product comes with the expected quality, in the quantity and at...

Adopting supply chain metrics, part II, financial metrics for sustainable profitability

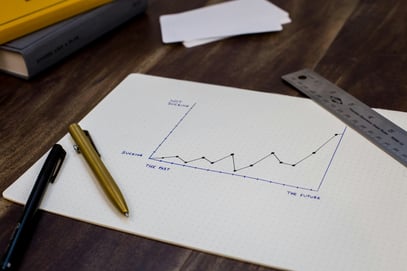

Along the mantra service-cost-cash, operational metrics would focus on the former. They would be looking outwards for service to customers and build loyalty. Cost and cash would be their financial metrics counterparts, while looking inwards to uphold enduring enterprise development.

A straightforward set of financial performance measures to sustainably pursue productivity and drive profitability. Such metrics maintain visibility on business health and support informed decision making.

Cost of goods sold

Cost of goods sold, aka COGS, represents the direct cost associated with producing goods or services. That would span up- and downstream, from sourcing through producing into distribution. Through costing information, business manage to evaluate process efficiency and identify optimization areas, while profitability brings a reliable competitive edge.

Cash to cash cycle

Cash-to-cash cycle time, aka C2C, represents the effectiveness of resource allocation even though tracking time. Similarly to the fulfillment cycle time or the inventory turnover rate, this metric would put the cash flow speed in the spotlight and act as confirmation for productive working capital usage. A key contribution to maintaining a competitive edge.

Return on investment

Return on investment, aka ROI, represents a longer term view on resource allocation. Significance, coherence and strength of strategy, business development, supply chain initiatives and priorities unfold through such metric. It then drive enterprise growth and sustainability.

Finding reference measurements may appear overly bold and even somehow looking for the holy grail. Each and every context indeed provides for different outcome while ending up in a tradeoff, yet surely holistically sound. Hands-on experience serves as a good guide and benchmark. It shows that early detection of exceptions could reduce processing cycle time 20-50%, for which measuring C2C would track resource allocation. Further, a robust operational model could avoid 5-10% potential product margin erosion to maintain profitability

Conclusion

Financial metrics within supply chain are essential for operational performance evaluation. COGS, C2C and ROI is a straightforward set of measures to sustainably pursue productivity and drive profitability. They maintain visibility on business health and support informed decision making to maintain service, cost and cash at their best.